Court throws out US$30-m default judgement for RBC vs Howell

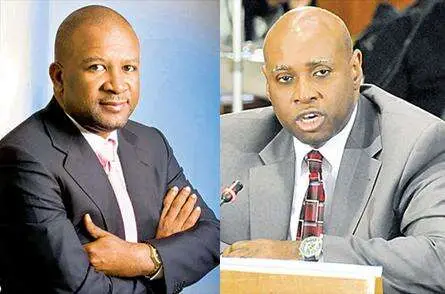

THE Supreme Court has thrown out a default judgement awarded to RBC Royal Bank for the collection of more than US$30 million ($2.9 billion) from businessman Delroy Howell, paving the way for a trial that could bring into question the administering of the key benchmark interest rate, LIBOR, by financial institutions in Jamaica.

RBC Royal Bank Jamaica Limited and RBC Royal Bank Trinidad & Tobago Limited — formerly RBTT Bank Jamaica and RBTT Bank respectively — in 2011 brought a lawsuit against Howell on a personal guarantee he gave for two loan agreements between 2005 and 2008 totalling some US$34.5 million with Ocean Chino Limited, which operated the Wyndham Kingston Hotel. The loans fell into arrears and the debtor and Howell failed to pay the amounts due, claimed RBC, which subsequently placed the property that housed the hotel onto the market for sale.

Howell filed a countersuit against the claimants for wrongful administration of LIBOR (London Interbank Offered Rate) rates, but the financial institutions obtained a default judgement last year after lawyers acting on Howell’s behalf did not file acknowledgement of service within the stipulated time as required by the rules of court.

However, Justice Ingrid Mangatal recently set aside the default judgement in the Supreme Court on grounds that Howell has a real prospect of successfully defending the claim.

“In my judgement, the ‘bottom line’ is that the defendant has raised a number of issues of law, including the construction of contractual documents and their meaning in the context of this case, that are not straight-forward,” said Mangatal in her ruling.

“These points require full, detailed and mature arguments that can best take place at trial. In my judgement, the defendant has demonstrated that he has a real prospect of successfully defending the claim — this is the most important consideration,” added Mangatal.

A trial date has yet to be set.

Howell, represented by attorney Douglas Leys, claims that RBC varied the interest rate with the debtor in a manner not contemplated by the loan agreements or the guarantee. According to court documents, the defendant argued that the loan agreements clearly show that the interest to be paid on the loan by the debtor was predicated upon two separate components — the fixed rate component, which was fixed throughout the life of the loan at 4.5 per cent, and LIBOR.

Depending on the fluctuations of LIBOR based on a six-month period, the debtor would have to bear the disadvantages of increases in LIBOR, and conversely, reap the benefits of decreases in LIBOR, Howell argued. The defendant said that this was a fundamental commercial arrangement on which he issued the guarantee and that if there were to be any material change to these arrangements he should firstly be notified and his agreement obtained before any such changes could be effected as regards his obligations under the guarantee. Given the fact that LIBOR rates had decreased in a fundamental and material way during the relevant period, the interest rates having been increased by the claimants during that time was in breach of the agreements and guarantee, according to the defendant, who added that it was done without notification to him and he had not agreed to any alteration in the arrangements.

Attorneys Emile Leiba and Gillian Pottinger represented the RBC Royal Bank institutions.

In response to Business Observer queries, RBC said: “We are aware of the claim, and due to the fact that this is a court matter, we cannot provide any further comments at this time.”

Describing the defence’s arguments as “real” and “bonafide”, Leys has expressed confidence that his client will prevail when the case goes to trial.

“I want to go on record as saying that the behaviour of the bank in this matter was outrageous,” said Leys, adding, “I am going to write to the Bank of Jamaica because I think Royal Bank should be investigated as to how they are administering Libor rates in Jamaica. In our view, it is a manipulation of the rates.”

Furthermore, the former solicitor general expressed high praise for the judge and the manner in which she dealt with what he said were “complex issues, which are not easily grasped in this area of international finance”.

LIBOR is the rate banks use to borrow from each other. The rate indirectly affects the cost of loans incurred by borrowers — such as when consumers buy a home or car.